davis county utah sales tax rate

The latest sales tax rate for North Salt Lake UT. 3 rows Davis County.

Rambler Homes In Utah Quick Move In Available Homes In Salt Lake County Utah Home Builders Model Homes House Design

Fast Easy Tax Solutions.

. See Publication 25 Sales and Use Tax General Information. 2020 rates included for use while preparing your income tax. Mobile and manufactured homes may be subject to tax sale when the outstanding taxes are one year delinquent.

A county-wide sales tax rate of 18 is applicable. Davis County sales tax. County Name Tax Rate.

The Utah state sales tax rate is currently. The Utah UT state sales tax rate is 47. Yearly median tax in Davis County.

735 Box Elder County. The median property tax in Davis County Utah is 1354 per year for a home worth the median value of 224400. 7705 or email to.

Has impacted many state nexus. With local taxes the total sales tax rate. Daggett County 05-000 485 100 025 025 100 735 Dutch John 05-002 485 100 025 025 100 110 845 Manila 05-006 485 100 025 025 100 735.

Falcon Hill Davis a 06-300 675 300 1132 775 1625 Falcon Hill Clearfield a 06-301 675 300 1132 775 1625 Falcon Hill Sunset a 06-302 675 300 1132 775. 91 rows This page lists the various sales use tax rates effective throughout Utah. The Davis County sales tax rate is.

Davis county utah sales tax. Depending on local jurisdictions the total tax rate can be as high as 87. These payment options are administered by a private company.

The current total local sales tax rate in Davis County. This rate includes any state county city and local sales taxes. May 18th 2022 1000 am - Pre-registration starts at 900 am.

At the Davis County Childrens Justice Center we serve over 1000 people per year interview about 450 kids each. The 2018 United States Supreme Court decision in South Dakota v. The 2022 Davis County Delinquent Tax Sale will be held.

Taxpayers may pay real estate property taxes to the Davis County Utah Treasurer using this on-line service or by telephone. Online Property Tax Payment. 06 of home value.

UT Sales Tax Rate. The state sales tax rate in Utah is 4850. Davis County Admin Building 61 South Main Street Room 105 Farmington Utah 84025 Mailing Address Davis County.

Annually a public auction is held for any property which has delinquent taxes. 11 rows The Davis County Sales Tax is 18. To find out the amount of all taxes and fees for your.

The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors. You may also call the Tax Commission at 801 297-7705 or toll free at 1-800-662-4335 ext. Utah state sales tax.

Davis County Administration Building Room 131. February 7 2022 flannel throw blanket walmart. Ad Find Out Sales Tax Rates For Free.

Sat May 7 1000 AM - 500 PM 198 S. Local-level tax rates may include a local option up to 1 allowed by law.

Utah Building Code Permit Place

How Healthy Is Davis County Utah Us News Healthiest Communities

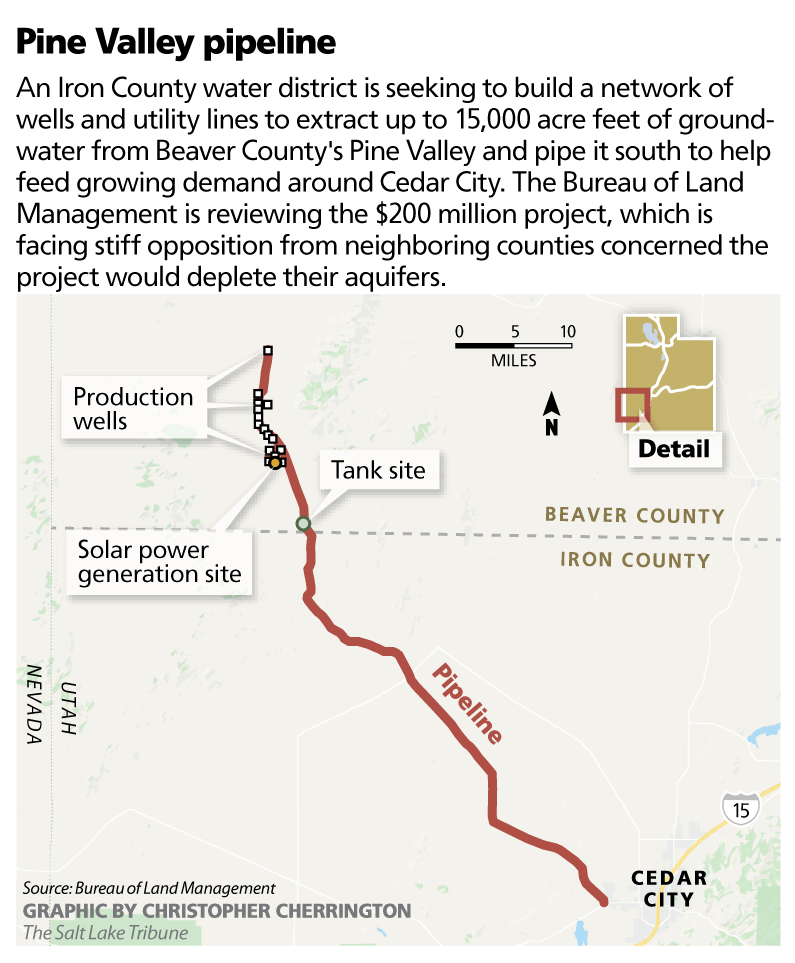

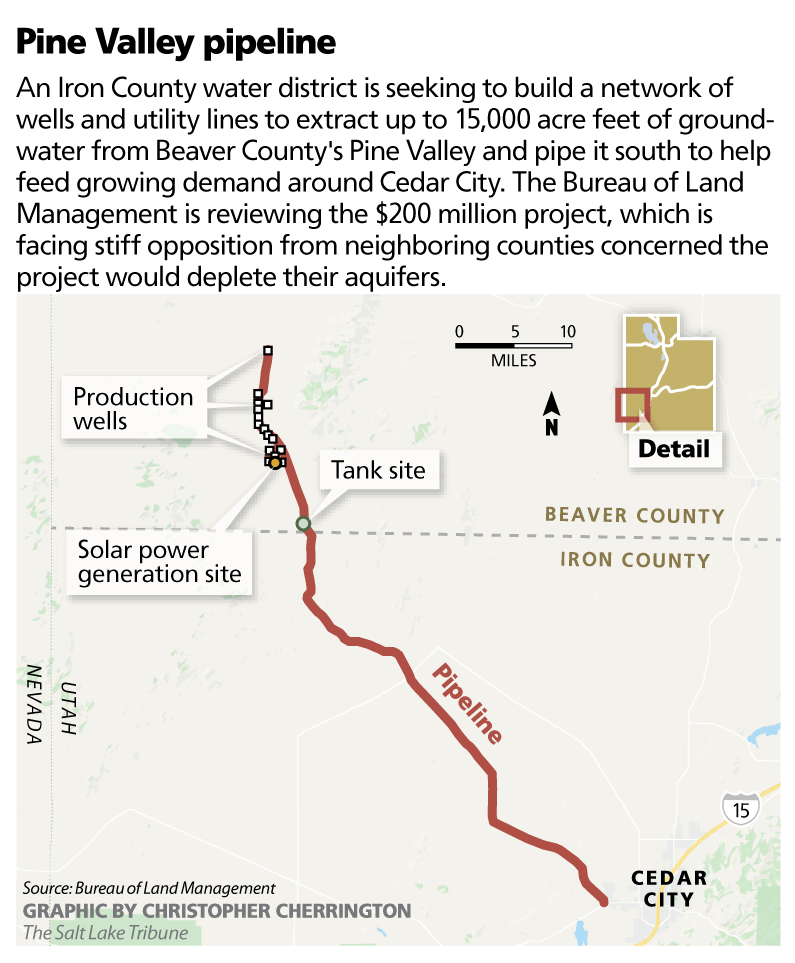

Is Cedar City S Growth Coming At Expense Of Rural Utah

Davis County Utah Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Utah Sales Tax Rates By City County 2022

2022 Best Places To Live In Davis County Ut Niche

Jordan Valley Water Conservancy District Proposes 180m In Infrastructure Bonds

Davis County Daviscountycomm Twitter

Best Places To Live In Davis County Utah

Davis County Utah Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Davis County Utah Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

New 2010 19 Population Estimates Utah Gains 456k Wasatch County Fastest Growing Kutv